Running the sales team for a company that sells multiple products is significantly more complex than running a team for a company that sells just one product. Especially if the products themselves are already complex — like SaaS products or medical devices.

And in times when new business is harder to attract, enabling your reps to sell across your product portfolio to existing customers becomes critical.

To keep your teams aware of cross-sell opportunities, every B2B sales leader should track product-specific metrics. Having a solid understanding of these metrics will allow B2B sales leaders to keep the team focused on what works in order to build revenue more predictably.

The following are six cross-sell metrics every B2B sales leader should track to maximize the return on your limited resources and keep the sales team as productive as possible in tight times.

Read the Sales Productivity eBook to learn how you can eliminate drains on seller time to increase revenue productivity.

Cross-sell metric # 1: Sales Effort Spent

Are your sales reps spending the right amount of time on the right products?

Make sure you’re tracking effort spent by your sales reps on each product. One way to make this easy is to assign specific sales reps to focus on each product. That way, you can look at the costs associated with those particular reps and apply it as your sales-related customer acquisition cost (CAC) for that product.

This approach isn’t always practical when it’s important for reps to have conversations about multiple products with prospects and customers. Instead, have them fill out a very simple spreadsheet at the end of each day to indicate the approximate percentage of selling conversations associated with each product.

It doesn’t have to be perfect — but knowing they’re spending about 25% of their time on product A and about 75% on product B is extremely valuable when trying to piece together the efficiency of their opportunity generation and CAC for each product. You could even go so far as to enable the reps to track product-specific activity in the CRM, like Salesforce.

This will give you more precise measurements of Sales Effort Spent on each product over time.

Cross-sell metric # 2: Activities per Opportunity (new business and cross-sell)

Are your sellers generating new pipeline as efficiently as possible?

As a sales leader, it’s important to understand the efficiency of opportunity generation by product. You can use the Sales Effort Spent metric to infer how much time reps are spending on each product. You’ll want to go one step farther and look at that figure for net new business and cross-sell for each product as well.

Again, this will depend on how you’ve set up your sales team. If reps only focus on new business or only focus on cross-sell, then it’s pretty straightforward. Otherwise, you’ll need to estimate the amount of activity associated with new business as opposed to cross-sell for each rep.

The advantage you gain by tracking this metric is huge. When it’s month two of the quarter and you’re behind your goal for opportunity generation, this metric is where you’ll turn. Aim your sales guns in the direction of your most efficient opportunity generating product to sustain you in the upcoming quarter.

Cross-sell metric #3: Win Rate (new business and cross-sell)

Are your reps leading with the right product?

It’s critical to understand new business Win Rates and cross-sell Win Rates for each of your products so you can establish a baseline to measure progress.

Having this information in hand will help you decide which product to lead with when talking to prospects. In many cases, companies have one product with very high new business Win Rates to use as the tip of the spear to land net new accounts. Then, they have multiple chances to generate cross-sell opportunities by having conversations with those customers about other products.

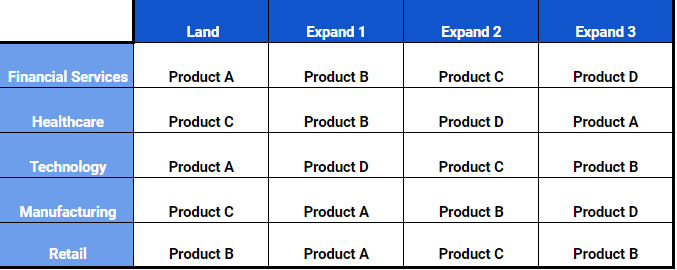

A more powerful and more sophisticated cut at Win Rate by Product is to slice these by segment. By tracking new business and cross-sell Win Rates by Product for the various verticals you sell into, you can develop a strategy and approach that works for each particular vertical.

For example, your data may show that your team does best in Financial Services when they lead with Product A and then cross-sell Product B, but don’t assume that works for every customer in every segment. You may very well find a different land/expand approach for your other verticals. For Healthcare companies, for example, it may make more sense to land with Product C and then cross-sell Product B based on the win rates there.

Tracking win rates by product helps sales leaders scale significantly faster. By looking at the product with the best net new win rates in a given segment or vertical, you’ll get more net new customers in the door. You’ll also generate more cross-sell revenue because you’ve created a larger base of customers with whom you can have cross-sell conversations.

Cross-sell metric #4: Attach Rate

Are you forecasting net new and cross-sell accurately?

It’s time to ask the team to move beyond relying on their gut when it comes to forecasts. That means taking a few minutes every quarter to calculate your Attach Rate by Product, cohorted by the first product that a given account has purchased. The formula for Attach Rate is simply the units of your second product sold expressed as a percentage of units of the first product sold.

In the B2B context, using dollars as your units tends to make most sense. So, if you sell $500k of Product A to a group of customers and then cross-sell $200k of Product B to those same customers, your Attach Rate would be calculated as $200k / $500k = 40%.

Attach Rate by Product is powerful for two reasons:

- More accurate forecasting of bookings and revenue. First estimate the number of new customers the team will close, and then use your Attach Rate to project how much in cross-sell bookings you’ll layer on top of the net new revenue.

- Smarter approach to cross-selling. By cohorting customers by the product they purchased first, and then showing the Attach Rates for each of your other products, you’ll get a sense of which products tend to go together, and how you can most effectively get a second product into the hands of an existing customer based on which one they bought first. For instance, you might see that customers who buy Product A first have a high attach rate for Product C, but a low attach rate for Product B. That’s a sign your team should focus on selling Product C to those customers who’ve purchased Product A.

You can get more sophisticated with this metric by slicing by another dimension, which would be the segment of the account (company size, vertical, revenue, etc).

The Attach Rate metric builds on the Win Rate, and when used together, it means you’ll be focused on landing the maximum number of new accounts, and then also generating the maximum volume of cross-sell revenue.

Get a comprehensive breakdown and cheat-sheet of formulas for the most important sales enablement metrics in this guide.

Cross-sell metric #5: Renewal Rate

Are you selling products with long-term value?

The Renewal Rate is an obvious one to track by product, because it informs the lifetime value of the sales you’re making. This metric is crucial for understanding whether the effort your sales and marketing teams are spending on a per-product basis is paying off in the long run, and should therefore be shared with your product team.

If your sales reps are spending time and energy selling a product, you want to make sure that your customers use it, get value from it and continue to use it. If customers aren’t renewing, then there is probably some work that the product team needs to do to make the product more valuable to the end-user.

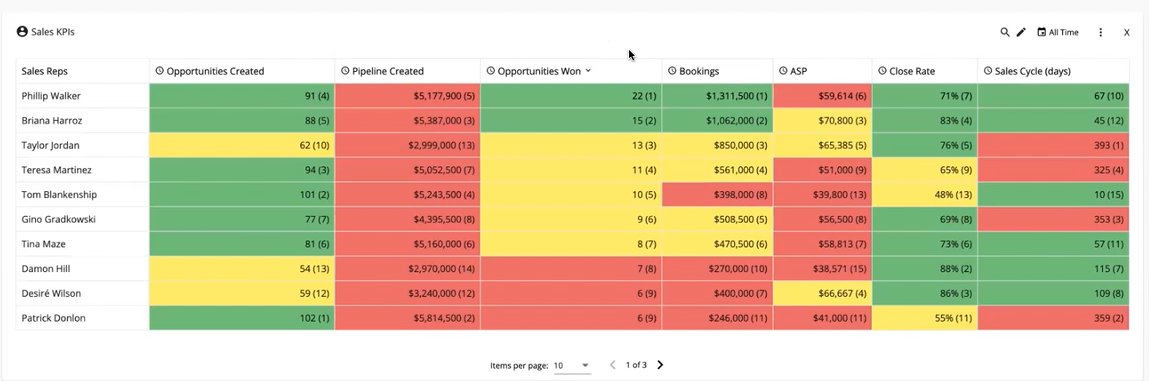

You can start automatically tracking these metrics today using our Sales Scorecards (shown below).

Cross-sell metric #6: LTV/CAC

Are you selling the most profitable products?

Armed with the first five metrics in this list, you’ll be able to produce an LTV/CAC ratio for each product, which tracks the relationship between customer lifetime value (LTV) and the cost of acquiring that customer (CAC).

This metric is extremely valuable because it will inform a host of business decisions, including where to invest product, development, marketing and sales resources.

To grow your business as effectively as possible over the long term, you’ll want to invest your team’s resources on those products with the best LTV/CAC ratios, as long as the total addressable market (TAM) for each of those products is big enough to sustain your growth targets. Once you start reaching TAM limitations you’ll want to focus your team on selling products with lower LTV/CAC ratios.

As with other metrics described in this post, you’ll gain more insight by breaking out the LTV/CAC ratio by product into segments. The LTV/CAC Ratio may differ significantly by industry, company size, and other attributes of the accounts you’re selling into.

Bonus metric! Key personas

Are you selling to the right buyers?

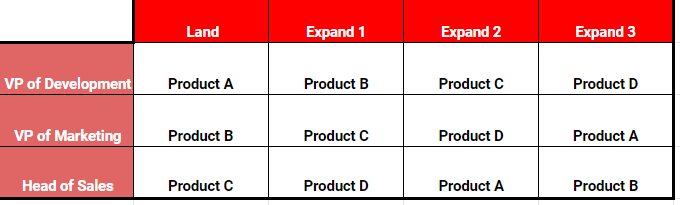

Key personas aren’t really a metric, but it’s important to consider which personas are most frequently attached to your deals by product.

By knowing which personas are the buyers and users of each of your products, you can determine whether the gap between products is small enough that it makes sense to cross-sell.

For instance, if the primary buyer of Product A is on the engineering team, but the primary buyer of Product B is on the marketing team, then you probably need to conduct separate lead generation and marketing initiatives in order to build awareness among your customers’ marketing organizations before you attempt to approach them about Product B. When the products and personas are close or overlap, you’ll have much more success cross-selling directly to the buyer of Product A or gaining an introduction to his/her colleague.

You could choose to segment your cross-sell strategy by industry or persona, but best practices would be a combination of both since roles and pain points will vary across verticals.

Bottom line

As a sales leader at a multi-product B2B business, it’s your responsibility to know these six cross-sell metrics — and key personas — in order to allocate limited resources wisely.

Calculate these metrics to establish a baseline, monitor them consistently to track your progress, and try a few experiments to improve your results.

Be sure to partner with your BizOps colleagues, such as a business analyst, sales ops analyst or someone in FP&A, to support you in your efforts and help you formulate the right strategy for your sales team.

If it’s a struggle to pull these six cross-sell metrics together for your business, reach out to our team for assistance.